“Tainted coins are destructive. If you break fungibility and privacy, you break the currency.” Andreas Antonopoulos

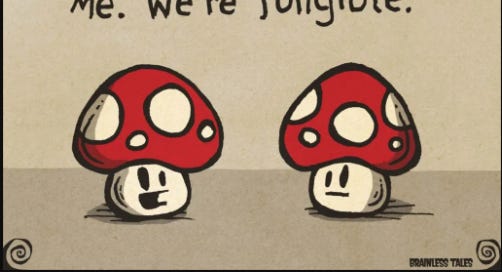

Fungibility refers to the property of goods, currencies and securities to be determinable by measure, number or weight and to be readily exchangeable or interchangeable.

Cryptocurrencies are determinable by number, but are not readily exchangeable in every case. This is because the vast majority of cryptocurrencies have their entire transaction history stored on the blockchain for all time, open for all to see. This is significant when coins can be associated with illegal transactions, even if they are only recognized as illegal at a much later point in time. It doesn't even have to be illegal operations in the true sense of the word, as recent events in Canada and Ukraine have revealed to us. It is enough to have the "wrong" opinion or even to belong to or be associated with a "wrong" ethnic group. Coinbase blocked 25,000 crypto accounts that could be associated with Russia. It was already enough to have Bitcoins in possession that had a connection to Russia at an earlier point in time. To justify this, Coinbase called it "illegal activities."

As you can see from this example, BTC is not fungible, as is generally assumed. It is the same with all other non-private cryptocurrencies as well, which store the entire transaction history for each wallet and coin transparently on the blockchain. From the centralized KYC exchanges (CEX), all incoming cryptocurrencies are scanned for "tainted coins" that are on a blacklist. Once such coins are found, the account of the person who brought them in is immediately frozen. The person can then state where he got these coins from. In the best case only these coins are confiscated. In the worst case, if it cannot be proven where the coins came from, it becomes a bigger problem.

So it can become very unpleasant if such "tainted coins" are acquired at a decentralized exchange (DEX). In a way, with cryptocurrencies that are not truly fungible, there is always this sword of Damocles hovering over you as soon as you acquire such coins at a DEX and want to exchange them later at a CEX. True fungibility in cryptocurrencies is only ensured if the origin of the coins cannot be extracted from the blockchain and therefore there can be no tainted coins or tainted addresses.

Only private and anonymous cryptocurrencies ensure 100% fungibility. Cryptocurrencies based on the Mimblewimble (MW) protocol deserve special mention, as they offer the best scalability with privacy. All other protocols, such as CryptoNote (Monero), Zerocash (ZCash, Pirate Chain) and others achieve privacy only at the expense of scalability with additional drawbacks.1

EPIC Cash occupies a special position among MW-based cryptocurrencies because it is designed according to the Bitcoin standard designed by Satoshi Nakamoto. A scalable, anonymous and private sound money with a maximum of 21 million coins, fast, fungible and low cost. A green & secure polyphasic proof of work consensus mechanism allows mining with low investment and opens up the possibility of billions of full nodes, even on mobile. It was launched fairly with no ICO, no premining or even team tokens. No corporation or foundation is behind it. It is community driven and run by a growing number of volunteers.

For more information, please visit www.epiccash.com

Another very good article on the problem of fungibility: Epic, Euro fungibility, and the end of the fiat delusion.

Great article - in fact, possibly your best yet! Wonderfully lucid.